The ERDF perspective

The ‘off the shelf ’ co-investment fund model

The off the shelf co-investment facility published by the European Commission in 2016 has proved to be a successful framework for ERDF equity funds in the 2014-2020 programming period.

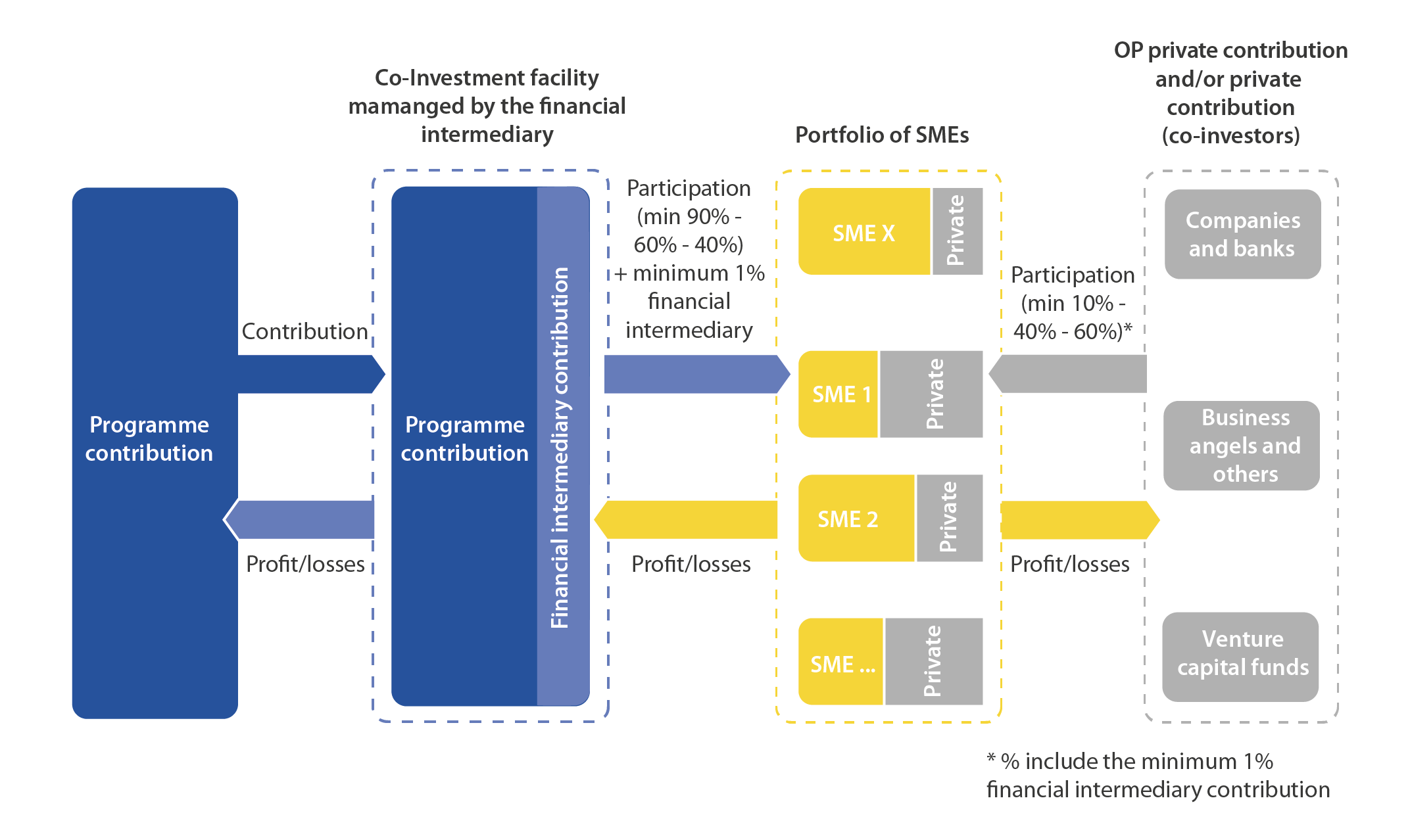

Figure 8: Schematic representation of the co-investment facility

The co-investment model relies on ERDF resources to crowd other investors to invest alongside the financial instrument in growing businesses, either through the fund manager or through direct investment in the company.

One of the features of the off the shelf model is the alignment of co-investment ratios with the requirements of Art 21 of the General Block Exemption Regulation (GBER) (Risk Financing). Minimum private sector participation varies depending on the stage of the life cycle of the target company as follows:

- Companies at the Research and Development and start-up phases, defined in Art 21 GBER eligible undertakings prior to their first commercial sale on any market must have a minimum private sector participation of 10%;

- Investments in early stage and expansion companies, defined in Art 21 GBER eligible undertakings operating in any market for less than 7 years following their first commercial sale have a minimum private participation of 40%; and

- For mature companies, defined in Art 21 GBER as eligible undertakings requiring an initial risk finance investment which, based on a business plan prepared in view of entering a new product or geographic market, is higher than 50% of their average annual turnover in the preceding 5 years, or for follow-on investments in eligible undertakings after the 7-year period of the first commercial sale investments by the co-investment facility require a 60% private sector participation in the fundraising.

EquiFund Greece: helping start-ups become unicorns

Think Silicon is a company based in Patras, Greece that specialises in high-performance, ultra-low-power graphic processing units (GPUs) and display controller technology. An EquiFund financial intermediary was lead investor in a fundraiser that took place in 2019.

Within 12 months of the investment, the company was acquired by Applied Materials, a NASDAQ listed company and one of Fortune’s ‘World’s Most Admired Companies’.

Instashop is an on-demand grocery hub with its tech hub based in Greece. The EquiFund financial intermediary VentureFriends supported the company’s growth during successive funding rounds, enabling the company to scale-up and become a market leader in the region.

In August 2020, the company announced its acquisition by the global leader Delivery Hero for USD 360 million, a record exit for a Greek start-up, returning significant funds to VentureFriends who can use the resources to re-invest in Greek SMEs.